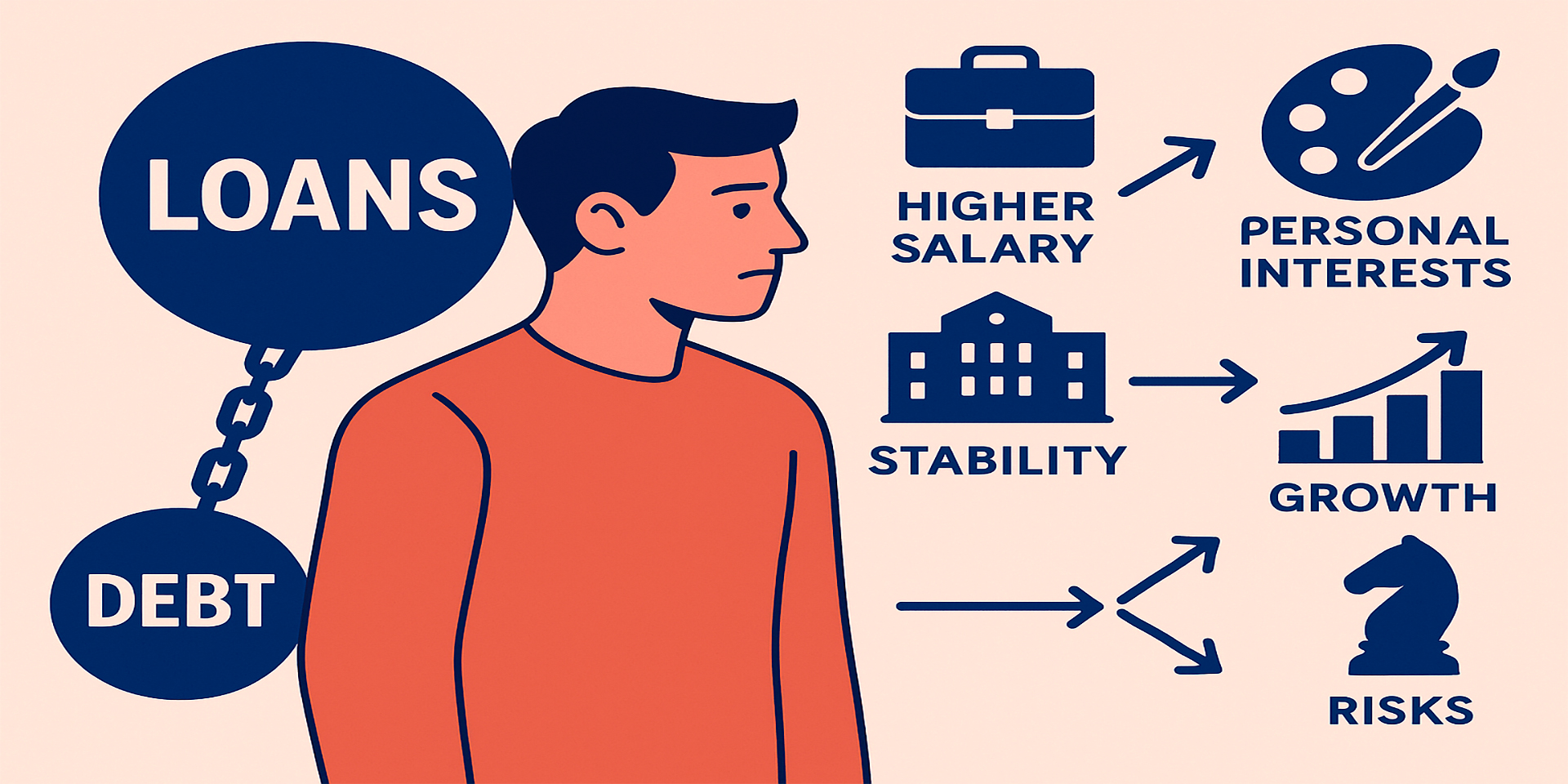

Loans don’t just shape your finances—they shape your future. Whether it’s student loans, personal loans, or credit card debt, the need to repay borrowed money can quietly direct your life choices. It affects where you work, how long you stay, what jobs you pursue, and whether you take risks or play it safe. For many people, especially younger workers, debt becomes a constant pressure that pushes them toward higher salaries over personal interests, stability over growth, and survival over ambition. This invisible influence is powerful—and it’s changing how entire generations think about work.

The Pressure to Prioritize Salary Over Passion

When Loan Payments Set the Career Path

It’s common to hear advice like “follow your passion,” but for people with large loans, that advice feels out of reach. Student debt, in particular, pushes graduates to take the highest-paying job they can get, even if it’s far from what they studied or truly care about. Creative fields, nonprofit work, education, or startups often fall off the list—not because they aren’t meaningful, but because they don’t offer salaries that can keep up with loan payments.

Financial Fear Replaces Career Exploration

Instead of exploring options, many graduates go straight into jobs they don’t enjoy because they feel they have no choice. The need to cover monthly payments—sometimes hundreds of euros—becomes the first and only filter. Passion projects, gap years, and entrepreneurial plans get postponed indefinitely, or abandoned completely. Over time, this can lead to burnout, regret, or feeling stuck in a career path that was never really chosen.

Debt Limits Career Mobility and Flexibility

Fewer Job Changes, Even in Bad Situations

Loans often lock people into jobs they don’t want to stay in. Even if a role is toxic or unsustainable, the fear of losing income—and falling behind on payments—keeps many employees from quitting. That’s especially true for people without savings or family support. Some delay leaving for better opportunities because of the time gap between jobs. Others avoid lower-paying positions with more long-term promise because they can’t afford the short-term cut in income.

Geographic and Industry Barriers

Debt can also stop people from moving to cities with better job markets if the cost of living is higher. Or from switching into new industries that require unpaid internships or retraining. For example, someone with high student debt might want to leave finance and move into environmental work—but can’t afford a 30% pay cut. Instead of moving toward their interests, they stay where they are, even if it limits long-term potential or personal fulfillment.

Entrepreneurship and Risk-Taking Decline

Fewer Business Ventures Among Borrowers

Starting a business, freelancing, or launching a creative project all require taking risks. But loans add pressure that discourages experimentation. Many borrowers don’t want to give up a steady paycheck, even temporarily, because missed payments can lead to penalties, credit damage, or added stress. As a result, fewer people with student or personal loans try to become self-employed—especially in the early years of their career when energy and ideas are highest.

Risk Avoidance Becomes the Norm

Debt teaches caution. People make choices based on security, not opportunity. They stay in jobs longer, say no to risky promotions, or avoid industries that rely on contracts and unstable pay. This cautious mindset might protect them from short-term financial trouble, but it can also block long-term growth, creativity, and innovation. When a generation is focused on making minimum payments, big ideas take a back seat.

Long-Term Debt Reinforces Job Insecurity

Living Month-to-Month Increases Dependence on Employers

When a large portion of your income goes to loan payments, there’s less room for saving. That makes it harder to build a financial cushion—or walk away from a bad job. Some borrowers live paycheck to paycheck, not because of poor spending habits, but because their loans leave no room for error. This gives employers more power: people are less likely to push back against unfair treatment, bad conditions, or unrealistic expectations when they know missing one paycheck could cause late fees or credit problems.

Debt and Workplace Stress Feed Each Other

Debt stress doesn’t stay at home—it follows people to work. It can affect focus, morale, and even performance. Studies show that employees with high financial stress are more likely to miss work, experience burnout, and struggle with mental health. At the same time, the fear of losing a job while still owing money increases pressure to overperform or stay silent about problems. The cycle continues, with little space to breathe or plan ahead.

How Debt Shapes Generational Career Trends

Millennials and Gen Z Feel the Weight Early

Younger generations are entering the workforce with more debt than ever before. They’re also facing higher housing costs, more job competition, and weaker social safety nets. For many, the first decade of their career is spent trying to “catch up”—not grow. Even talented graduates often spend years in high-pressure jobs they don’t enjoy just to manage their debt. And because debt delays milestones like buying a home or starting a family, it pushes people to make career decisions based on stability rather than timing or personal goals.

Debt Delays Retirement and Career Changes Later

It’s not just a young person’s problem. Mid-career professionals often delay retirement or avoid switching paths because they’re still paying off debts from years ago—or taking on new ones for their children. Career changes in your 40s or 50s are harder when loan balances are still high. Even refinancing or consolidating debt can extend the timeline, leaving people stuck longer than expected. Instead of planning for the next chapter, many are just trying to stay afloat in the current one.

What Can Help Break the Pattern

Better Financial Education From the Start

Many borrowers don’t fully understand how loan terms will affect their future. Interest rates, repayment schedules, and job market realities often become clear only after graduation. Offering real financial education—before taking out loans—can help people make better choices. Understanding the trade-offs between degrees, career fields, and borrowing can reduce future regret and improve long-term outcomes.

Policy Solutions to Ease the Burden

Governments and institutions can play a role too. Income-based repayment plans, lower interest caps, and partial forgiveness programs help reduce pressure. Some companies now offer student loan repayment as part of their benefits package. These steps don’t erase the problem—but they can make it manageable, giving people more freedom to pursue meaningful work instead of just the highest paycheck.

Loans don’t just affect what you buy—they affect how you live and work. For many, debt silently reshapes careers, limits choices, and adds stress that doesn’t go away at the end of the workday. It forces people to prioritize security over growth, income over fulfillment, and stability over curiosity. Understanding this impact is the first step to changing it. If we want a workforce that thrives—not just survives—we need to build systems that support financial freedom, not permanent pressure.