Finding the right cashback credit card isn’t just about perks—it’s about using your daily spending to your advantage. Whether you’re fueling up the car, buying groceries, or paying your phone bill, the right card can quietly refund a portion of what you spend. But with dozens of offers out there, each with fine print and flashy bonuses, picking the right one can feel overwhelming. Let’s break down what really matters—so you can turn ordinary purchases into real, ongoing rewards without getting burned by fees or hidden terms.

Why Cashback Credit Cards Make Sense

Cashback cards give you something back for money you’re already spending. It’s not about spending more—it’s about earning smarter. Unlike points or miles, cashback is simple: you get a percentage of your purchases refunded directly. That can mean €300, €500, or more per year if you match the card to your lifestyle. Whether you’re a heavy spender or just covering essentials, cashback helps your money stretch further, provided you avoid interest and fees.

Simple and Tangible Rewards

With cashback, there’s no complex redemption. You either get money deposited into your account or credited against your balance. It’s immediate, transparent, and easy to track—no points to convert, no blackout dates, and no expiration headaches.

Great for Consistent, Everyday Use

Cashback cards shine when you use them for purchases you’d make anyway. Think groceries, gas, utilities, subscriptions. If you pay your balance in full each month, you’re essentially being paid to use your card.

Annual Cashback Can Add Up Fast

If you spend €1,500 per month and earn 1.5% back on average, that’s €270 a year—free money just for paying smart. Some cards even offer quarterly bonuses of up to 5% in rotating categories, meaning even more back with strategic use.

- Flat-rate cards offer a consistent return, typically 1.5–2%.

- Tiered cards give higher rates on categories like supermarkets or fuel.

- Rotating bonus cards require tracking categories but offer the highest potential rewards.

Every euro you spend can stretch a little further if your card is tailored to your habits.

How to Match a Cashback Card to Your Lifestyle

No two cashback cards are alike. Some favor frequent travelers, others reward supermarket runs or online shopping. Your spending patterns should drive your choice. A card that gives 5% back on travel is useless if you don’t leave your city. On the other hand, a consistent 2% on everything may be ideal for someone who doesn’t want to track categories.

Start With Where You Spend the Most

Pull up your last three months of bank statements. Are you mostly spending at grocery stores? Restaurants? Online? Look for cards that offer elevated cashback in those areas. That one adjustment can double or triple your annual rewards.

Decide Between Flat-Rate and Bonus Categories

- Flat-rate cards (e.g., 1.5% on everything) are easy to use and require no tracking.

- Tiered cards (e.g., 3% on gas, 2% on dining, 1% elsewhere) maximize value but need some attention.

- Rotating category cards (e.g., 5% on specific merchants each quarter) offer high returns if you plan purchases around them.

Think of your card as a tool. The more precisely it fits your routine, the more it pays off over time.

Annual Fees: When They’re Worth It—and When They’re Not

Some of the best cashback cards charge a yearly fee—usually between €30 and €100. That might seem like a deal-breaker, but don’t write them off too quickly. If the rewards and perks you get outweigh that fee, the card could still come out ahead. However, if you’re a light spender or won’t use the bonus categories, fee-free cards are a safer bet.

Break Even Before You Commit

Let’s say a card charges €80 annually and offers 2% cashback. You’d need to spend €4,000 a year just to break even. That’s about €333 per month. If your spending is lower, look for a no-fee option—even if the base rate is a little lower.

When to Accept a Fee

Annual fees make sense if:

- You get higher cashback rates that exceed what a free card offers.

- The card includes extras like insurance, extended warranties, or concierge services you’ll actually use.

- You regularly hit spending thresholds that unlock higher-tier rewards.

As with any financial product, if you’re not using the perks, the fee is wasted. But if you are, it’s just the cost of bigger returns.

Watch for Traps That Can Cancel Out Rewards

Cashback is only beneficial if you’re not paying interest or falling into hidden-fee territory. That 2% reward means nothing if you’re paying 19% interest on a balance you carry. The same goes for late payment fees, foreign transaction charges, and cash advance penalties.

Never Carry a Balance

The golden rule of cashback cards: pay in full, every time. Most cards offer a grace period of 25–30 days before interest kicks in. Use that time wisely. If you start paying interest, your rewards evaporate quickly.

Check the Fine Print

- Some cards cap rewards at a certain annual amount—read the limit.

- Others require you to manually “activate” bonus categories or rewards quarterly.

- Look for redemption minimums. Some cards don’t let you cash out until you hit €25 or more.

If you don’t know the rules, you could be leaving cash on the table—or never getting it at all.

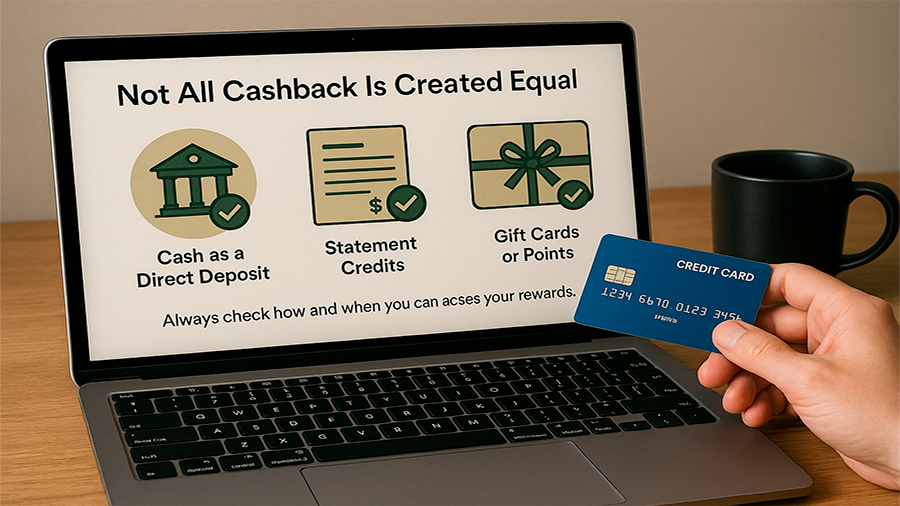

Look at Redemption Options and Flexibility

Not all cashback is created equal. Some cards offer cash as a direct deposit. Others give you statement credits. A few offer “cashback” as gift cards or points with limited value. Always check how and when you can access your rewards.

Faster Is Better

The best cards let you redeem any amount, any time, directly into your account or as a statement credit. If you have to wait until you hit a high threshold or convert points manually, that slows things down—and adds frustration.

More Options, More Control

Top-tier cards let you choose how to redeem—cash, deposit, credit, gift cards, or even investment account contributions. Flexibility matters, especially if your financial goals change throughout the year.

Don’t Forget Sign-Up Bonuses

Many cashback cards offer a welcome bonus if you spend a set amount in the first few months. These bonuses can be worth €100, €200, or more—basically, a free boost to your earnings just for using the card. But they’re only helpful if you can meet the minimum spend without overspending.

How to Make the Most of It

Time your application around a big purchase—furniture, travel, a phone upgrade—and hit the threshold with money you were going to spend anyway. That way, the bonus becomes a reward, not a burden.

Avoid the Trap

Never apply just for the bonus. If the card doesn’t match your long-term habits, it’s not worth keeping. Look beyond the flashy offers and focus on lasting value.

Choosing the right cashback credit card means understanding your spending habits and matching them with a card that rewards you—without punishing you with fees or complexity. Look for cards that make sense in the long run, offer flexibility in rewards, and help you save money on things you already buy. A little research now can mean hundreds of euros back in your pocket each year—and smarter, smoother spending every day.